CAR INSURANCE

Save up to 40% when you drive less – only with PrOmilej Insurance

KEY FEATURES

OPTIONAL BENEFITS

We offer a selection of extra benefits to keep you extra safe. For an additional premium, we cover:

- Windscreens, windows and the sunroof.

- Special perils, such as floods.

- Strikes, riots and civil commotion.

As of the 19th of March 2021, there is a reduction in the premium for these, depending on your plan.

We also offer Passenger Liability Cover.

WHY INSURE WITH US

Did you know? On top of keeping you and your vehicle protected, there is so much more you can enjoy when choosing us!

10% Cheaper Premiums

Get a 10% discount when you renew your insurance online. Tired of going to the counter? You can now purchase your insurance via our website or mobile application!

Easy Renewal

Easy Renewal – You’re only a few clicks away from your payment.

Secured Online Payment

Our reliable online payment partner, iPay88, is regulated under Bank Negara Malaysia and conforms to the highest international security standards (PCI DSS 1), as well as the Financial Services Act 2013.

FAQs

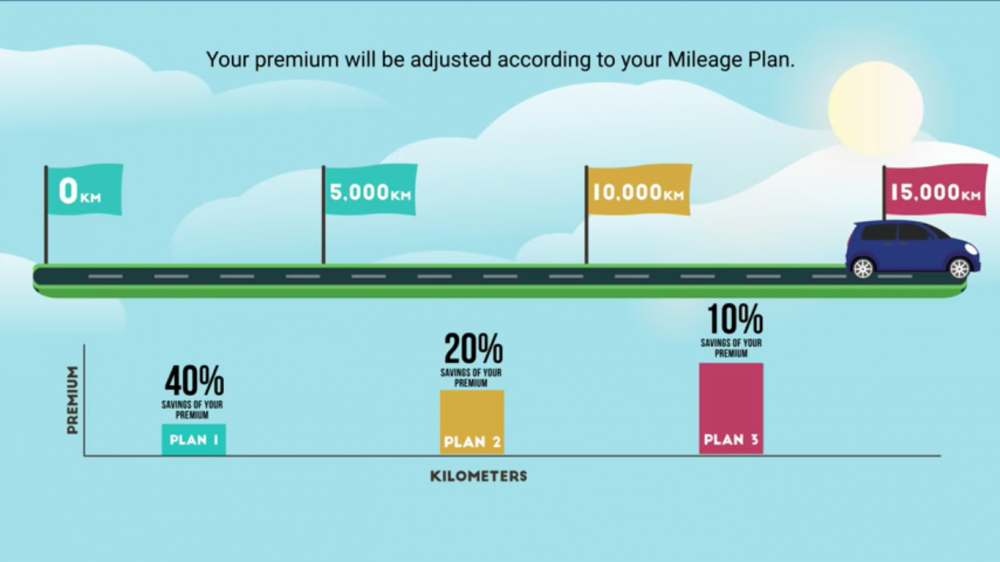

PrOmilej offers all the benefits of our comprehensive plans for less. Based on how far you plan to drive, PrOmilej provides savings to keep both you and your wallet secure.

There are currently 3 plans available:

Plan 1: 40% savings for annual mileage less than 5,000km.

Plan 2: 20% savings for annual mileage less than 10,000km.

Plan 3: 10% savings for annual mileage less than 15,000km.

You will save between 10% to 40% on your basic premium (inclusive of the premium for the optional benefits listed above, if applicable) depending on the PrOmilej Plan you choose.

You can purchase PrOmilej by using our mobile application (POI2U), visiting our website or by calling our call centre.

Yes, however you should take note of whether it is cost efficient for your based on your existing insurers short term cancellation rates.

To submit a reading via our mobile app:

Step 1: Launch our mobile application, POI2U.

Step 2: Click “Click here” at the bottom of the page for access to more products.

Step 3: Click on the “PrOmilej” tile.

Step 4: Click “Submit Odometer Reading and Mileage”.

Step 5: Enter your vehicle’s registration number and your ID.

Step 6: Take a photo of your car’s odometer reading and enter your odometer mileage reading.

Step 7: Enter your email and other required details.

Step 8: Click “Submit”.

No. You must submit a photo of your odometer reading via our mobile application or online before you buy PrOmilej. Without this, we reserve the right to cancel your policy.

Yes, you can. You should give us written notice that you want to. Once cancelled, you can get a refund of your premium paid which is based on us retaining the customary short-term premium or minimum premium.

If you exceed the distance you’ve been given, don’t worry. An extra 500km is given to you before the end of your policy.

If you have exceeded both your allocated distance and the additional 500km, your vehicle will no longer be covered for any loss, damage or other optional benefits. However, third-party cover remains unaffected.

You should top-up your plan before you exceed your limit. This will ensure you and your vehicle are fully protected on the road.

You can buy a top up the same way you bought the policy- online, through our app, or simply calling us. It costs the difference between your current policy and the new one.

For example, if your current plan costs you RM500 and the next plan is RM800, you will only be charged RM300.

You can top up a maximum of two (2) times.

Additional 500km is provided to you if you exceed your allocated mileage before the end of your policy period.

If you have exceeded your allocated mileage and your Grace Mileage, and you have not topped up, you will only be covered for third party bodily injury or death and third party property damage but not loss or damage to your vehicle due to accident, fire or theft. (For PrOmilej policies issued after 19 March 2021, optional benefits listed above in 1. above will not be covered if you have exceeded the allocated mileage and Grace Mileage).

Once cover has started, you can top up to the next level of mileage available or to Full Mileage Cover by paying an additional premium. A maximum of 2 Top Up’s are allowed. If you top up for the second time, you can only top up to Full Mileage Cover.

No downgrade of the plan is allowed.

No, you cannot downgrade your plan. You will not receive a refund or be able to carry your unused mileage to a new plan either.

There are a few things you should keep in mind after buying our PrOmilej policy:

- Provide an accurate odometer photo and reading at the start of, renewal and claim on your policy.

- Make sure your odometer is always functional.

- Check your odometer regularly to make sure your cover distance has not run out. Top up your plan if needed.

We will send you regular reminders to check your mileage as well, just in case.

Yes, you do.

Vehicles of up to 20 years can buy PrOmilej. This includes newly purchased vehicles as well.

There will not be any device installed on your vehicle to track on your mileage. You are only required to submit your current car mileage upon the purchase of the insurance. We will check on your mileage again in the event of a claim. We will also send you regular reminders to check on your own mileage.

Yes, you can. However, you should try to ensure you top up prior to exceeding the limits.

You can contact our staff at 1-800-88-2121 to resubmit your odometer photo one day before your insurance begins. We will then make the necessary changes.

Yes. You can buy the flood or windscreen cover at a premium that corresponds to your allocated mileage.